Much to the dismay of many local residents, the federal government has lowered the "flood" boom, so-to-speak. With the implementation of the new FEMA (Federal Emergency Management Agency) flood zone maps on August 5th, many residents are finding that their property and homes are now classified as being in a special flood hazard area. This can be a very big deal.

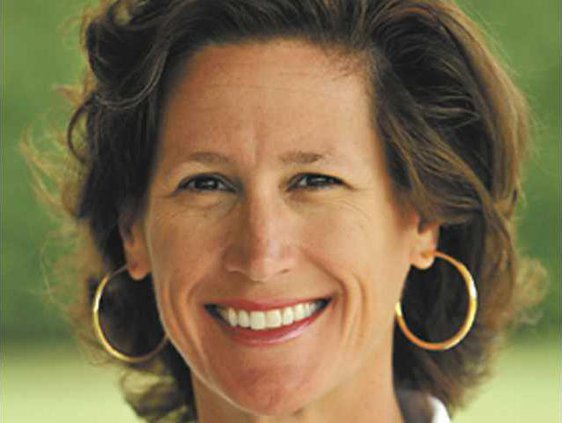

Inside Bulloch Business with Jan Moore - Don't need flood insurance? Check the map

Sign up for the Herald's free e-newsletter