I have written about real estate a great deal over the last several years. Like everywhere else in the country, Bulloch County and the surrounding area have gone through a boom and now a significant slowdown since 2003. Most news stories, including mine, have focused on the deterioration of residential and commercial values.

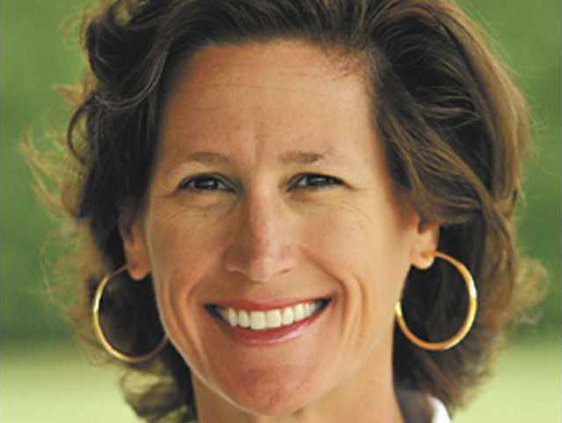

Inside Bulloch Business with Jan Moore - Timber! Value of forest land sees decline

Sign up for the Herald's free e-newsletter